Many experts disagree about whether market bubbles can be predicted or prevented. Real estate bubbles generally occur about every 13 years and last for about 2 ½ years when they happen. Housing bubbles create a greater effect often that stock market bubbles do. The main economic perspective on a real estate bubble is that it can increase wealth, and redistribute wealth for the country. When prices and values are increasing, there is a positive effect on the economy, because home and property owners are feeling wealthy and spending more money. When the bubble bursts and values come down rapidly, the economy is negatively affected because property owners are spending less. Owners won't be greatly affected if they don’t sell their home during the “burst” period.

In St. George, the real estate market is currently recovering from the bubble and decline of the early 2000’s, and property values are again building.

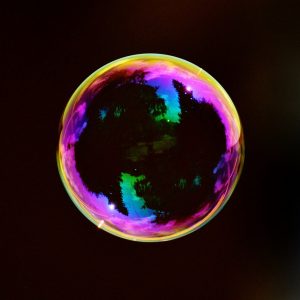

What Was the Real Estate Bubble?

Real Estate Bubble

HolidayResortRealty.com

No comments:

Post a Comment